Economic Focus: Why Housing Won’t Crumble – A Rational Look at US Supply & Demand

- August 12, 2022

- •

- by Nick Allison, Analytics Manager

With headlines about GDP, arguments about definitions of recession and whether or not we are in a recession (we won’t get into that today), inflation at the highest levels in my lifetime (based on CPI) and painful gas prices, many in our industry might be concerned about the outlook for the housing moving forward.

Those in the plywood and related markets should be keeping an eye on U.S. housing — specifically single-unit starts. Through internal work, we’ve determined the single strongest predictor of domestic hardwood plywood production (as measured by DHA — formerly HPVA — surveys) is single-unit starts in the United States.

There are other factors — remodel activity and competitive imports — but housing is the primary mathematical yardstick for demand. If one has concerns about the hardwood plywood market, it’s understandable one would worry about the housing market.

Whether or not we are in recession is a valid debate, but one I will abstain from today.

Irrespective of GDP, we have seen housing slowing recently, with July starts declining by 8% year-over-year, according to the St. Louis FRED website (seasonally unadjusted figures).

In fact, we project single-unit housing will end 2022 down 2-3% as compared to last year. However, Columbia and our economic forecasting partner project moderate growth in single-unit housing in both 2023 and 2024. How can this be with higher interest rates and rampant inflation?

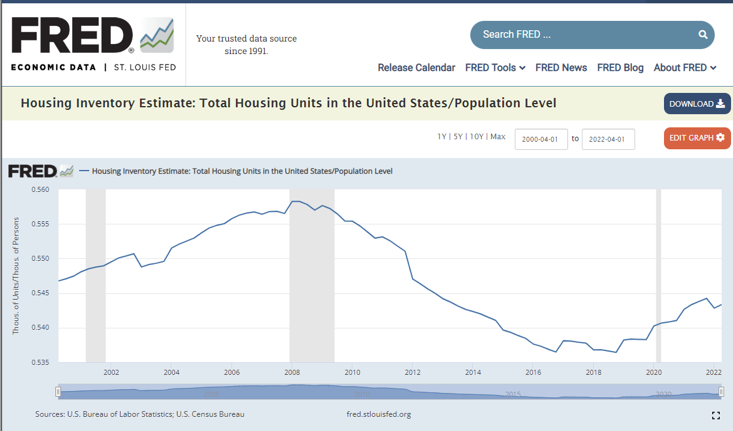

A key factor in positive outlook for housing lies in inventory levels. According to the St. Louis FRED data, there are currently 0.543 housing units per person in the United States. The data set only goes back to 2001 when levels were around 0.547.

This rate climbed to an unsustainable level, peaking at 0.558 in Q1 2008, right before the Housing Crash and recession. Over the next ten years, the inventory per person dropped down to the data series low of 0.536 in Q4 2018. Since then, the inventory per person has risen slowly to the Q2 2022 mark of 0.543.

While we certainly don’t want to reach pre-Housing Crash levels, we still have a while to go to reach a “safe” level of about 0.550. Builders still have scars from the ’08 crash and are hesitant to overbuild for fear of a repeat of history.

This phenomenon combined with rising interest rates, labor costs, availability and material costs should help to prevent inventories from reaching dangerously high levels. Most importantly, this shows there is still room to grow and is one of the reasons we expect a soft landing for housing in the United States.

In addition, surveys indicate many who were ready (in terms of life stage) to purchase a home did not do so during the COVID recovery, as house prices soared — preventing many from purchasing their first or second home. As prices continue to regress, this should allow more new families to make their first purchase, assuming interest rates do not exceed 6.5%.

Another study, conducted by Up For Growth (a non-profit focused on housing shortages), estimates the U.S. homes deficit more than doubled from 1.65 million to 3.8 million between 2012 and 2019. The deficit has surely shrunk since 2019, but there remains a great deal of room to grow for housing.

As mentioned earlier, we expect housing to end 2022 down 2-3% from 2021.

However, the 12-month rolling rate will bottom out at around -5% near the end of 1H-2023. This is evidenced by the 12-month rate seen in new housing starts permits, which starts by about six months. From there, we project growth in the 12-month rolling rate for single-unit housing, ending 2023 around +2% and expecting slightly more growth in 2024.

This projection is not without risks, as inflation continues to be high, fuel remains costly for the average American, GDP figures create tension in markets and headlines and the Fed’s behavior is always a wildcard.

Barring any black swans, we expect a bounce-back for housing in the second half of 2023 and sustained growth for 2024. This should result in a relatively flat 2023 for domestic hardwood plywood manufacturers and moderate growth in 2024.

Despite the headlines — and excepting unlikely adverse macro events, the next 24 months should be relatively healthy for our industry.