Economic Focus: Super Bowl Outcomes vs Housing Starts

- March 2, 2023

- •

- by Nick Allison, Analytics Manager

How Chinese Spy Balloons and Earthquakes Figure In To Forecasting (or Do They?)

In the world of prediction, we use models to glimpse into the future. In a simplistic manner, the models used for prediction assume the event or time horizon we’re examining will be played out a large number of times.

Assuming we have a good model (caveat: this often is not a great assumption!), simulating a given year or event many times allows us to have some level of confidence regarding the range of outcomes.

In the sports betting world, this is seen in the point spread, the point total and the money line (and the hundreds of other props or bets offered for the Super Bowl). Take the most recent Super Bowl for example, where the Eagles were favored by 1.5 points at most books at game time.

If the Eagles played the Chiefs 10,000 times in real life, of course we would not expect 5,000 games to end with the Eagles winning by exactly one point and 5,000 games with the Eagles winning by exactly two points. We would instead see a wide range of outcomes and the average would be expected to be an Eagles victory by 1.5 points.

However, that assumes the betting markets are a perfect representation of this matchup, which it certainly is not (it is rather good, however). As we saw in the Super Bowl, the game was indeed very close as expected, though the underdog ultimately won.

Often times, when teams are close, it is one play, one call, one coaching mistake that can change the outcome of the game. Depending on who you rooted for, you might have identified a few of these potential “tripwires.”

Our trusted economic advisors—who have an excellent track record—have developed models to forecast a variety of economic sectors to enable their customers to plan optimally. Like any good model, there are ranges of expected probabilities of certain outcomes.

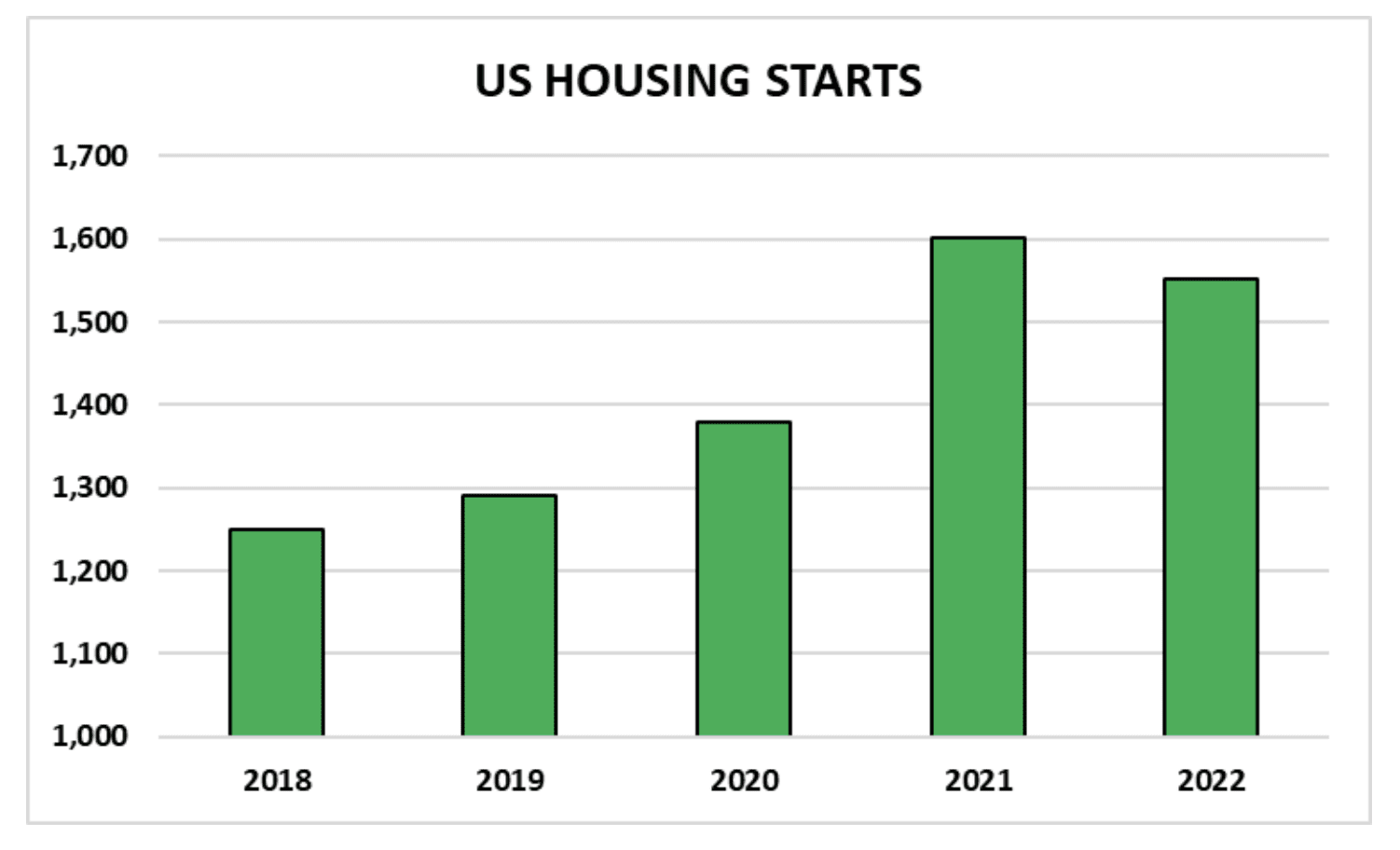

For GDP, we expect—on average—a mild rise in the first half of 2023 before a flat trend for the second half. Single unit housing starts ended 2022 down 10.6% YoY, as starts have declined double-digits for each of the past seven months!

This was primarily due to affordability, as interest rates increased in the second half of last year and the cost of labor and materials skyrocketed under general rapid inflation. Despite some positive news on the interest rate front, we expect to see the YoY declines in Starts continuing through the first quarter of this year.

The rate of change will then start to recover, but not enough to avoid another decline in single unit housing starts in 2023. However, expect growth in single starts the following two years. Despite the decline in housing, we are projecting a relatively flat year for domestic plywood production in 2023.

Back to the Super Bowl. The economic projection of rise and subsequent flattening of GDP, housing declining and plywood production being flat are like the betting lines of the game. These “spreads” or forecasts are the best we can do with the information we have at the moment.

In the real economic world, instead of a questionable call or a crazy fumble, we have the global geopolitical theater and the Federal Reserve. China and the US destroying the others’ alleged spy balloons. Active war in Ukraine. Rhetoric between the Sino-Russian alliance and the US heating up. The Nord Stream gas pipeline. Potential interest rate hikes. Chemical train cars in Ohio. Unusual earthquakes in Turkey. And banking confidence questions.

Not only are events like these impossible to forecast, but we have no way to know the interdependencies of these events. Unfortunately, we don’t get to go through 2023 ten thousand times and take the average year—we only get one shot!

So, while we don’t expect a rough 2023 for domestic hardwood plywood on average, the relatively high amount of uncertainty in the world forces us to be prepared for unusual outcomes.

Like a football coach adjusts in the event of a key injury or an ineffective game plan, companies would be wise to scenario plan for possible outcomes of 2023 and be prepared to adjust quickly. It’s impossible to game plan an infinite number of outcomes, but leaders and managers can select a handful of likely scenarios and develop tactical plans in the event a given scenario comes to play.

Hopefully, the average (or better!) outcome comes to fruition and we will look back at this time of uncertainty much like we did during the Cold War of old.